Car title loans Orange TX provide quick cash but carry risks like vehicle repossession, high interest rates, and strict repayment terms. Borrowers must carefully review loan terms, understand Texas regulations protecting them from predatory lending practices, and be aware of potential consequences to their credit score and financial stability.

Considering a car title loan in Orange, TX? It’s crucial to understand the potential risks before you commit. This guide breaks down the intricacies of car title loans in Orange, from understanding the lending process to exploring financial dangers and legal protections. By familiarizing yourself with these aspects, you’ll be better equipped to make informed decisions regarding your financial future.

- Understanding Title Loan Processes in Orange TX

- Financial Risks and Repayment Challenges

- Legal Implications and Protection for Borrowers

Understanding Title Loan Processes in Orange TX

In Orange TX, car title loans have become a prevalent source of financial assistance for many individuals seeking quick cash solutions. Understanding the process is crucial before diving into such an arrangement. It involves a lender using your vehicle’s title as collateral to secure a loan. Once approved, the lender will hold onto the title until the debt is repaid in full. The beauty of these loans lies in their accessibility; even those with less-than-perfect credit may qualify. However, it’s essential to grasp the Loan Terms and conditions to avoid potential pitfalls.

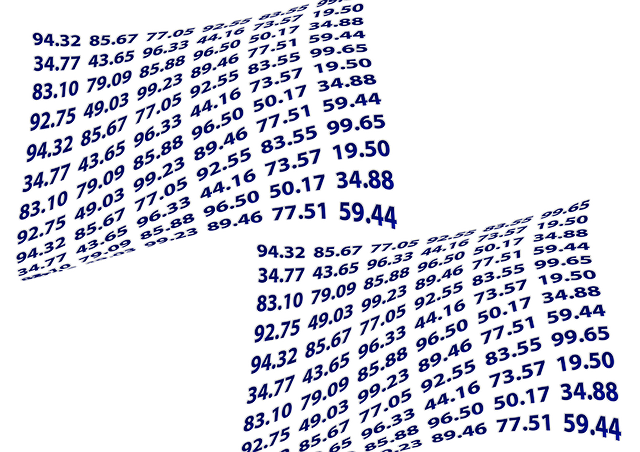

The approval process typically entails providing proof of vehicle ownership, a valid driver’s license, and income verification. Lenders will assess your ability to repay based on these factors. While car title loans can offer a fast and convenient way to access funds, it’s vital to consider the interest rates and repayment terms carefully. Repayment plans vary, but borrowers should be prepared for potentially higher interest charges compared to traditional loans, especially if they have less-than-optimal credit scores.

Financial Risks and Repayment Challenges

When considering car title loans Orange TX, it’s crucial to be aware of the potential financial risks and repayment challenges that come with this type of loan. These short-term loans use your vehicle’s title as collateral, which means if you’re unable to repay the loan on time, you could lose your car. The interest rates for car title loans are often significantly higher than traditional loans, making the total cost of borrowing substantial. Moreover, if your financial situation changes unexpectedly, meeting the strict repayment deadlines can be difficult, leading to a cycle of debt.

The Title Loan Process can be complex and involves several steps. Lenders require you to submit an online application providing detailed information about your vehicle and your personal finances. While this may seem convenient, it also increases the risk of errors or inaccuracies that could affect your loan eligibility. It’s essential to thoroughly understand the terms and conditions of the loan before agreeing to them, as late payments or defaults can have severe consequences for your credit score and financial stability.

Legal Implications and Protection for Borrowers

When considering car title loans Orange TX, borrowers must be aware of the legal implications and protections available to them. In Texas, as with many states, these loans are regulated to safeguard consumers from predatory lending practices. The state’s laws dictate terms such as interest rates, repayment schedules, and collection procedures, ensuring fairness and transparency throughout the title pawn process.

One key protection is the ability to repay the loan without facing illegal or harsh collection tactics. Borrowers are entitled to understand the full extent of their obligations, including any associated fees and penalties. Additionally, if a borrower defaults on payments, they have legal recourse options to explore before repossession, offering potential avenues for financial assistance within the confines of the law.

When considering car title loans Orange TX, it’s crucial to weigh the financial risks and legal implications discussed in this article. While these loans can provide quick cash, the potential consequences—such as repayment challenges, loss of vehicle ownership, and limited borrower protections—cannot be overlooked. Before proceeding, thoroughly understand the process and explore alternative solutions to ensure a well-informed decision.